Broker Insights’ Information Security Officer, Karen Sutherland, outlines the key data security considerations:

Independence

In regulatory terms, brokers and insurers can primarily be classified as ‘data controllers’, as they directly collect personal information from ‘data subjects’, determine the purpose or outcome of processing, and select the ‘data processors’ they choose to work with.

To adhere to regulatory obligations, such as the General Data Protection Act, the selection and oversight of the data processors they choose to work with is a critical consideration.

A ‘data processor’ is any third party the data controller uses to process personal data on their behalf. Amongst the various obligations, data controllers should ensure that the processors they work with are able to provide suitable guarantees for technical and organisational measures covering all processing activities. The data controller must assess the competence of the processor, taking into account GDPR requirements, the nature of the processing and risks to data subjects, e.g. data ending up in the hand of a processor’s parent company without the controller’s knowledge.

Data processor Privacy Policies should clearly state which data processors they share data with and the reason for sharing, which should be covered under an agreed contract.

Broker Insights is an independent company. We do not have ownership links with other brokers or insurers. We have no hidden agenda for brokers’ data. Our privacy policy details our lawful basis for data processing activities. To access a copy of the policy, click here.

For further guidance on data-sharing contracts with processors, visit: https://ico.org.uk/for-organisations/accountability-framework/contracts-and-data-sharing/.

For information on writing a privacy policy/notice, visit: https://ico.org.uk/for-organisations/sme-web-hub/how-to-write-a-privacy-notice-and-what-goes-in-it/

Purpose

What are the aims of the organisation you are considering partnering with? What lawful basis do they have for processing data?

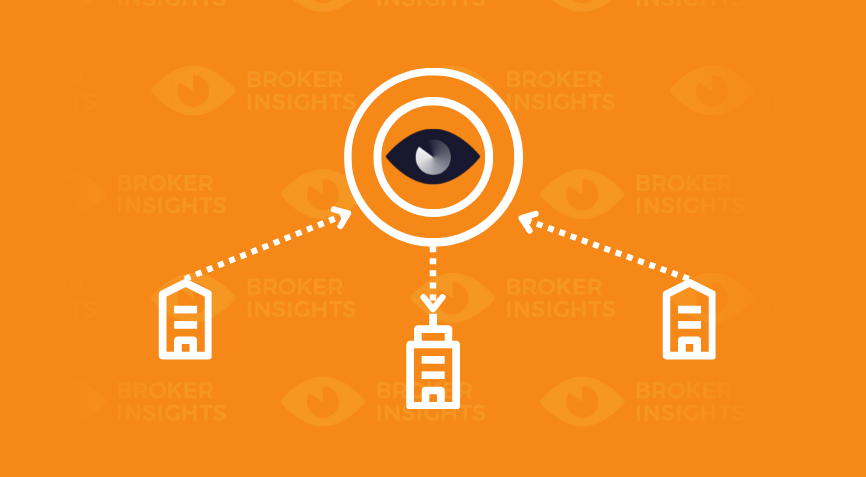

Broker Insights has a clear purpose; we bridge the knowledge gap between brokers and insurers, to connect workflows and drive efficiencies in the commercial insurance market.

There is no ‘hard sell’ with Broker Insights; brokers freely choose to use the technology, to join our purpose, and to maximise the value of their data.

Data Privacy, Security of Data & Compliance

Broker Insights maintains ISO 27001 certification, which is an internationally recognised standard for maintaining an information security management system. This, along with following the British Assessment Bureau accreditation process, demonstrates that data privacy, security of data and compliance are paramount to us.

In keeping with compliance requirements, insurer partners’ view of brokers’ data is redacted, anonymised, and names are never shown.

Our upload process is secure – we do not require brokers to send spreadsheets via email and have secure methods of data transfer which meet the requirements of ISO 27001.

Support

Data can be incredibly complex and no two companies are the same. When choosing data solutions, organisations should fully explore the support mechanisms in place to help them embed the solution within their workflow and drive usage.

Broker Insights supports partners every step of the way:

- Our Customer Success Team work closely with you to get set up and comfortable, offering demonstrations and help sessions throughout

- Once set up, our Trading Team act as account managers, supporting your every need and providing continued training where required

Members of our broker community have freedom of choice over the insurers and products they use. Broker Insights’ role is to identify partner insurers with an appetite for each risk and support brokers’ ability to engage with those markets.

Data Quality & Value

When selecting options to integrate into an information workflow, quality of data becomes a key issue. The solution will never deliver desired results if the quality of the data being processed is not effectively managed.

Brokers partnering with Broker Insights benefit from a Data Quality report following each upload. Data Quality Reports highlight errors or omissions in uploaded renewal data, which have helped brokers reduce the incidence of issues from 1.20% of GWP in January 2022 to 0.03% of GWP in December 2022: a 97.50% decrease.

We recognise that sometimes, you simply “don’t know what you don’t know”; our technology highlights issues in your data to drive efficiencies and help you improve quality.

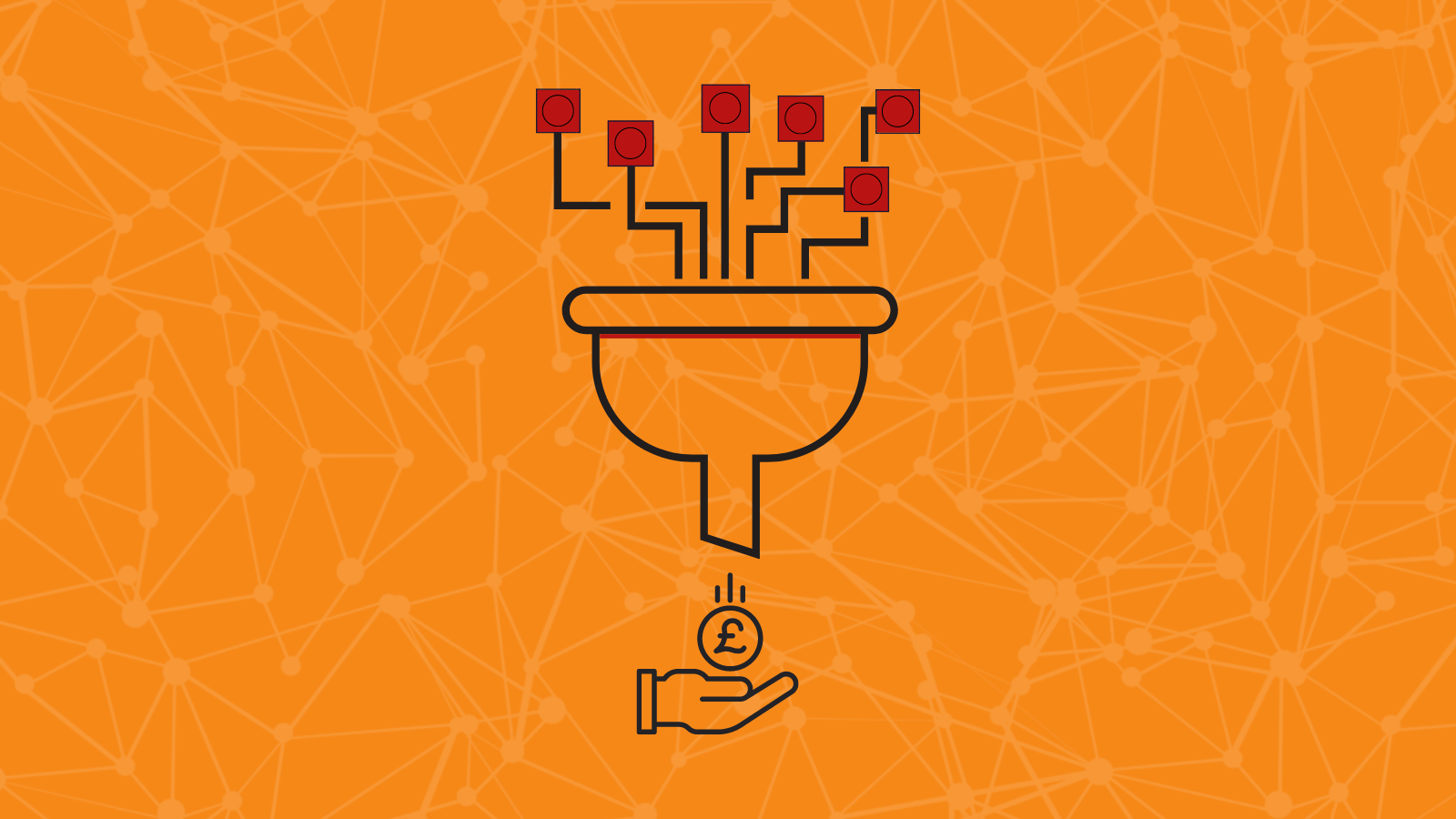

System Agnostic & Streamlined

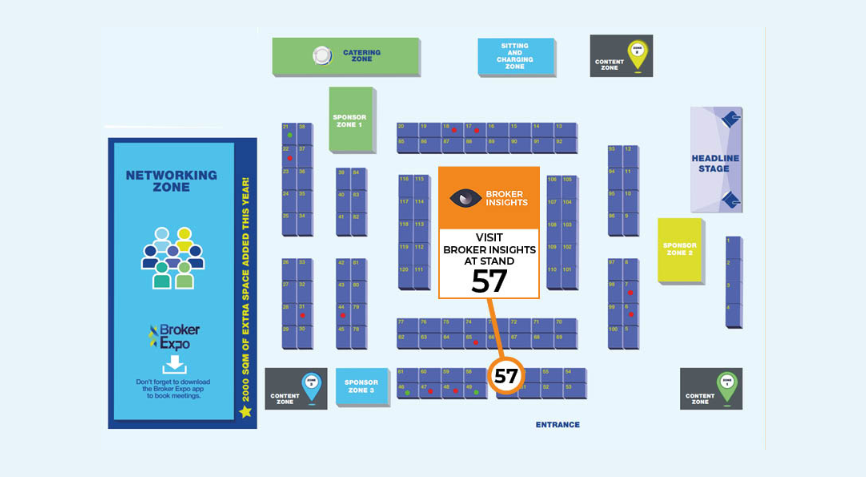

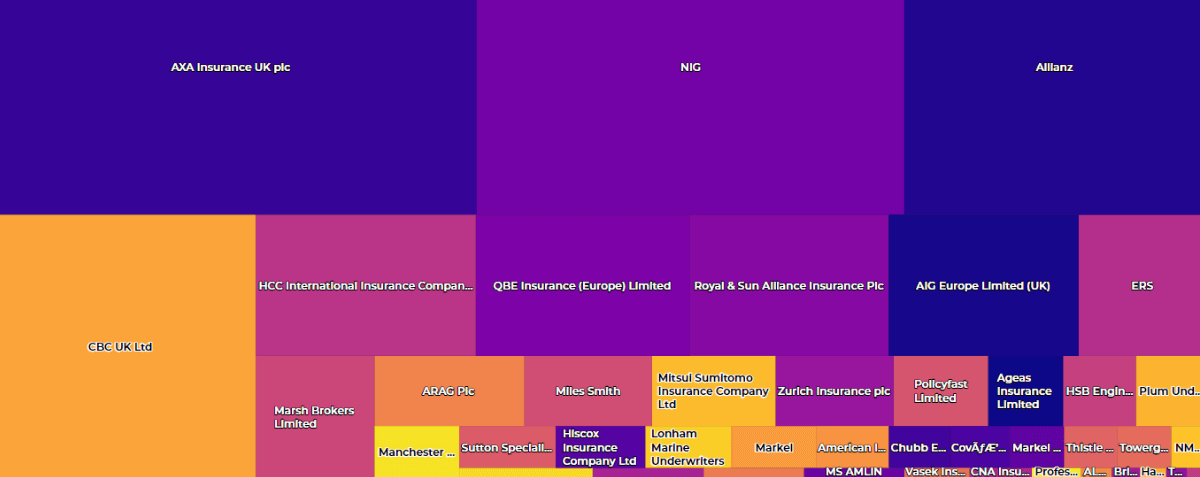

The commercial insurance sector hosts a huge array of broker software houses and proprietary systems. Broker Insights is system agnostic, currently accepting data from 19 different software houses or broker systems (and counting).

Once uploaded, our unique processes re-classify variations in business class descriptions, from 1,500+ separate interpretations across 640k+ policies, to 132 standardised terms, supporting the intelligent matching process.

Conclusion

The commercial insurance sector is changing, driven by an increasing shift towards digitisation, technological offerings and legislation around security of data.

We pride ourselves in our tight data controls, making Broker Insights the independent solution for brokers seeking to extend the value of their data.

UK Website

UK Website USA Website

USA Website