Can a broker perfect placement, and if so, what would it look like?

Each insurance broker manages their placement strategy according to the requirements of their business, insurer relationships, clients, etc. In short, there is no one-size-fits-all answer.

However, some principles can be broadly applied, such as the benefit of placing more business with preferred insurer partners.

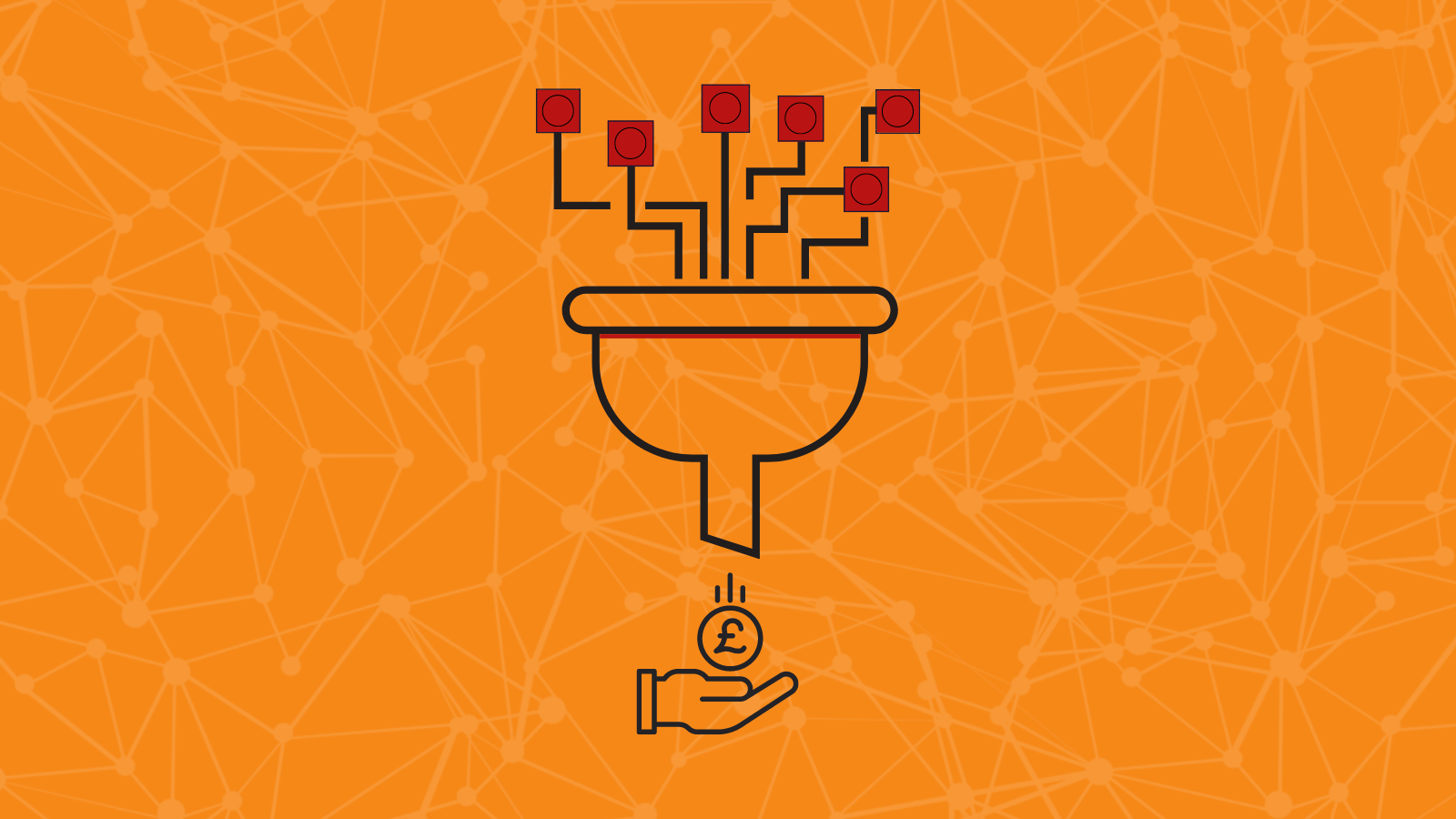

Agency management can be a hidden cost for brokers, as the time and resource required to manage each relationship is often not accounted for. A large agency base can impact a broker’s ability to engage effectively with insurers and may also have a detrimental effect on service and revenue.

Analysing ‘service’ in relation to the size of a broker’s agency base is difficult to quantify, but revenue-related analysis is much more straightforward.

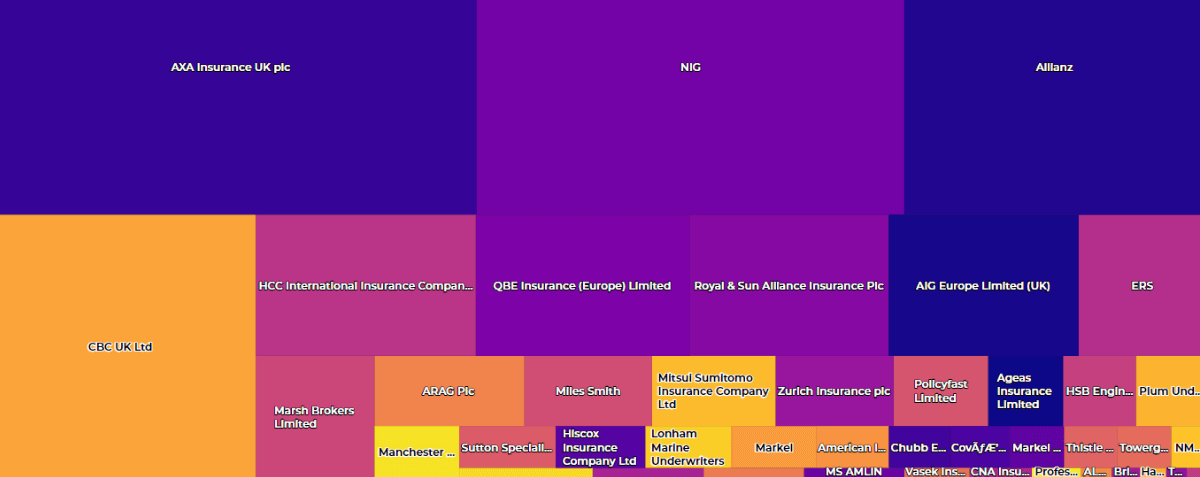

Investigations of the aggregated data set within Broker Insights VisionTM shows that brokers with between 50 and 74 agencies appear to be able to leverage better deals with their insurer partners than smaller brokers with up to 49 agencies, or those with 75 or more markets.

Furthermore, it follows that the fewer agencies a broker maintains, the less time it will take to manage administrative activity with insurers, undertake due diligence exercises, manage financial reconciliations, etc.

Brokers that actively rationalise the number of markets they maintain, avoid the hidden costs associated with a large agency base.

Rationalising agencies can unlock the benefits of better terms with preferred partners, reduce admin costs, and develop closer professional relationships and service, while maintaining the ability to place the right risks in the right markets in support of client outcomes.

Remember: the time and effort required to manage a large number of agencies, often for a small number of policies per agency, will ultimately impact a firm’s ability to maximise profits and resources.

Is your placement strategy harming your bottom-line growth?

A robust placement strategy helps brokers to grow faster with key partners, thanks to the following main benefits:

- Profitability: A well-executed placement strategy helps you to efficiently secure coverage for your clients at competitive rates, whilst optimising commission and revenue.

- Resource Allocation: A robust strategy ensures you allocate resources effectively, saving time on untargeted market engagement and improving operational efficiency.

- Regulatory Compliance: Rationalising agencies reduces the resource required to manage compliance with regulatory requirements.

A well-designed placement strategy helps insurance brokers increase revenue, reduce risks, and improve their overall financial performance.

Broker Insights provides an award-winning toolkit to help create and execute your placement strategy.

If you would like to discuss your placement strategy, contact the Broker Insights Trading Team today and be sure to follow us on LinkedIn.

UK Website

UK Website USA Website

USA Website