Broker Insights helps to facilitate better broker and insurer relationships by focussing engagements from a position of knowledge. Bridging the knowledge gap increases effectiveness and efficiency, delivering better outcomes.

Here are five ways in which the platform can support insurers when engaging with regional brokers:

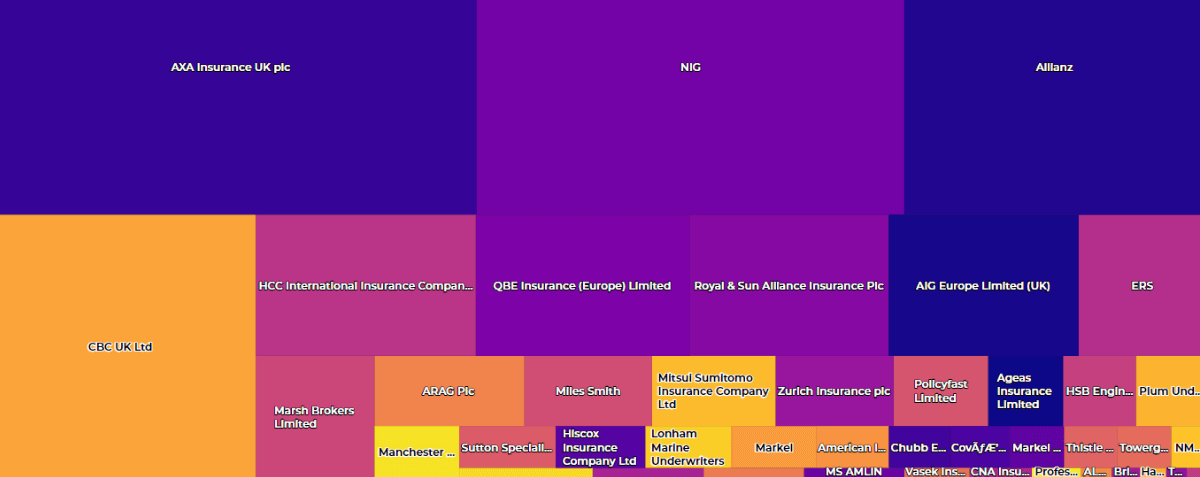

Market Coverage

Broker Insights has over £1bn of commercial GWP within the platform (and growing), which represents around 12% of the commercial insurance market.

The platform enables insurers to search through an anonymised view of our partner brokers’ books of business and identify opportunities which meet underwriting appetites.

This is a unique offering from Broker Insights, which represents a transformational change to the working practices of the sector, improving insurer distribution capability and streamlining engagement with regional brokers.

Knowledge

Broker Insights gives insurers a way to engage in an accurate, relevant and efficient dialogue with brokers in relation to specific in-appetite risks and conduct high-level discussions on policies of interest through the platform, in real time.

The combination of the ‘Right Products’ to the ‘Right Customers’, at the ‘Right Time’ helps insurers to capture the full potential of the renewal broking window.

Responsiveness

An insurer using Broker Insights will be able to correspond with regional brokers on a wealth of available information, from held business, market share, and breakdown of products, to renewals and new trade deals.

By utilising the potential of data to work closely with regional brokers, an insurer can gain a strategic advantage, bringing clarity to new opportunities and valuable insight into a constantly changing marketplace.

Relationships

The relationship between insurers and brokers is at the core of the sector. Broker Insights bridges the knowledge gap or ‘data-divide’, allowing both parties to accurately identify and target their market engagements.

A higher quality of market engagement and inbound proposals contributes to a higher rate of quotation and a reduction of waste. This in turn helps to strengthen trading relationships, as both parties benefit from the efficiencies that data-driven decisions provide.

The platform is flexible enough to undertake many of the time-consuming administrative tasks involved with prospecting or marketing, allowing insurers to engage with brokers in a focussed and efficient manner.

Education

Regional brokers need to understand what is within an insurer’s risk appetite if they are to accurately target their market presentations.

Our Broker Relationship Management team frequently encounter brokers who comment: “I didn’t realise that XYZ insurer was interested in this type of business…”

Broker Insights’ appetite match-making functionality helps to inform and educate brokers about each insurer’s underwriting appetite, which supports the re-broking of business towards partner insurers and helps those firms that are keen to rationalise their agency base.

UK Website

UK Website USA Website

USA Website