Traditionally, underwriting has been predominantly manual and paper-based, with underwriters relying on their expertise and judgement to assess risk and make decisions. A circulating question is: can technology do this better?

With increasing digitisation in insurance, we’re seeing a shift from traditional underwriting processes to more automated AI and machine learning-based processes. Areas such as personal lines insurance have quickly embraced the change, with some using telematics and other IoT devices to gather real-time data about risks and exposures. Other areas, however, such as commercial lines insurance, have been slower to adapt – due, in part, to the complex and varied nature of the risks involved.

With an underwriter’s role focusing on writing profitable risks, access to information to support decision-making is critical. Rate, retention and profit are front of mind, occasionally putting underwriters out of step with sales colleagues whose focus is typically on new business and growth. This creates a complex dynamic, which technology may struggle to grasp without human intervention.

Nevertheless, something we repeatedly see in the media and trade publications is a conversation around technology taking jobs and the potential for these processes to replace human underwriters. While Broker Insights champions the use of technology and data in revolutionising the industry, we still believe that commercial insurance is a people business. Therefore, we view this ‘problem’ as an opportunity; one which provides underwriters with tools to streamline their workflows and make better-informed decisions.

Commenting on the supporting role of tech, Alan Sanderson, Chief Commercial Officer, believes that:

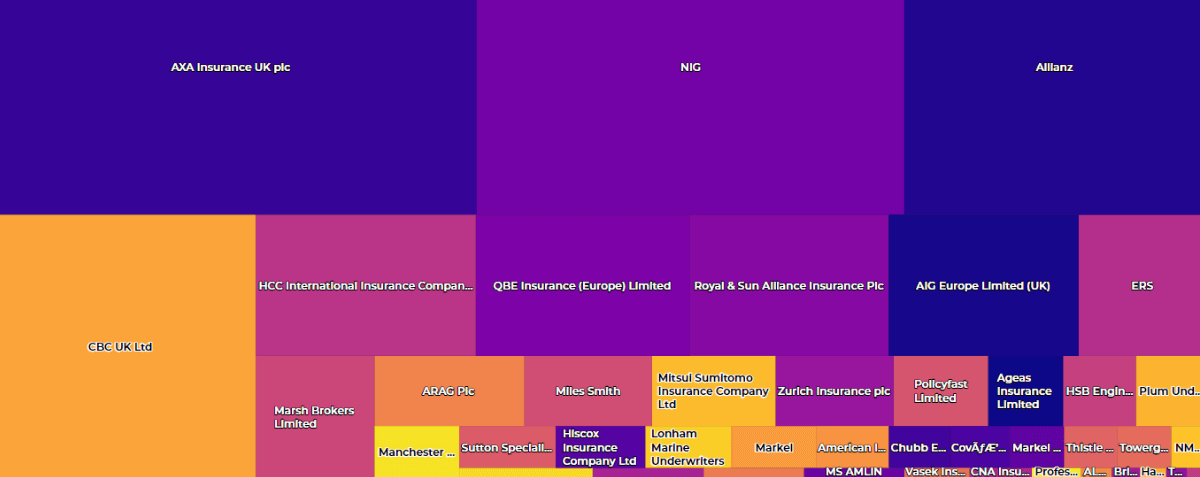

“Broker Insights’ ever-growing view of the market, coupled with visionary product development, moves our technology towards a pioneering position whereby we can better inform underwriters’ decision-making process.

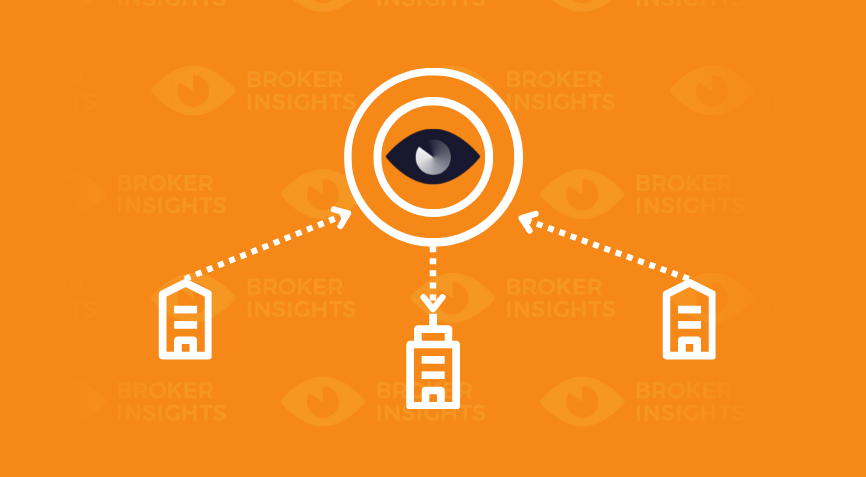

“What started as an innovative platform matching brokers’ risk data with insurers’ appetites will soon evolve into a model which better supports underwriters by providing insight into opportunities within the wider held book of a broker, beyond the immediate risk they are considering. This overcomes the shortfall of single instance data, allowing an underwriter to consider a risk within the context of the complete ‘opportunity picture’ at a broker, the relationship development benefits and the impact on portfolio-level strategy planning.

“At Broker Insights, we firmly believe that giving underwriters access to a more complete data view will allow them to better shape decision-making, target more of the types of cases they are winning, overcome the need for sales staff to ‘sponsor’ opportunities they wish to champion, and ultimately, better serve the broker market.”

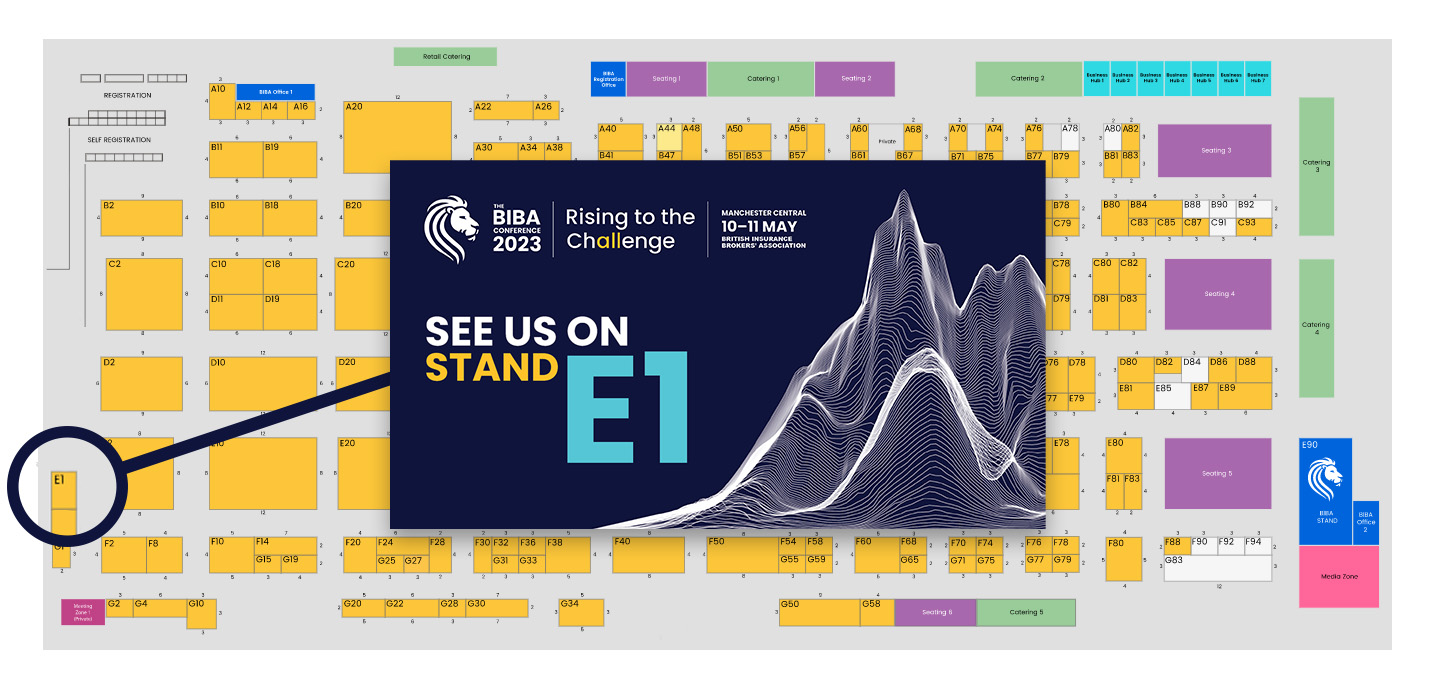

Join us ahead of BIBA as we introduce ‘The Data Revolution’ and explore how

Broker Insights’ better use of data can transform commercial insurance.

UK Website

UK Website USA Website

USA Website