For brokers with ambition, organic rates of growth don’t cut it. They are keen to seek out means to accelerate commercial development, engage efficiently with insurers, and increase market share.

Calculating an average growth rate for commercial brokers is a tricky business. Market conditions, broker profile and speciality, organic growth vs growth by acquisition, etc. all have an impact on the result, which is likely to sit somewhere around the 5-15% mark year-on-year.

In this article, we highlight the levers that brokers can pull to help achieve growth rates ahead of the market, and also explore real world examples from the Broker Insights team and fast-growing members of our broker community:

Inform Insurer discussions:

WM Brokers (formerly Woodward Markwell) joined the platform in July 2020 and have utilised the dashboard displays as the foundation of meetings with their insurer partners. Thomas Hallat of WM Brokers believes that the ability for insurers to proactively search for in-appetite business within the platform has been of great benefit within the last two years:

“Broker Insights has been working with WM Brokers as an important Partner in building & managing relationships with our Insurer Partners.

Our software house provides raw management information and dashboards, however Broker Insights ‘breathes life’ into this data, helping us to discuss opportunities with our Insurer Partners.

Being able to interactively review our client book with our Insurer Partners in real time improves the productivity of such meetings.

Our Insurer Partners have also been using Broker Insights to proactively prospect our clients, which is very refreshing.”

Proactively manage placement across the entire business:

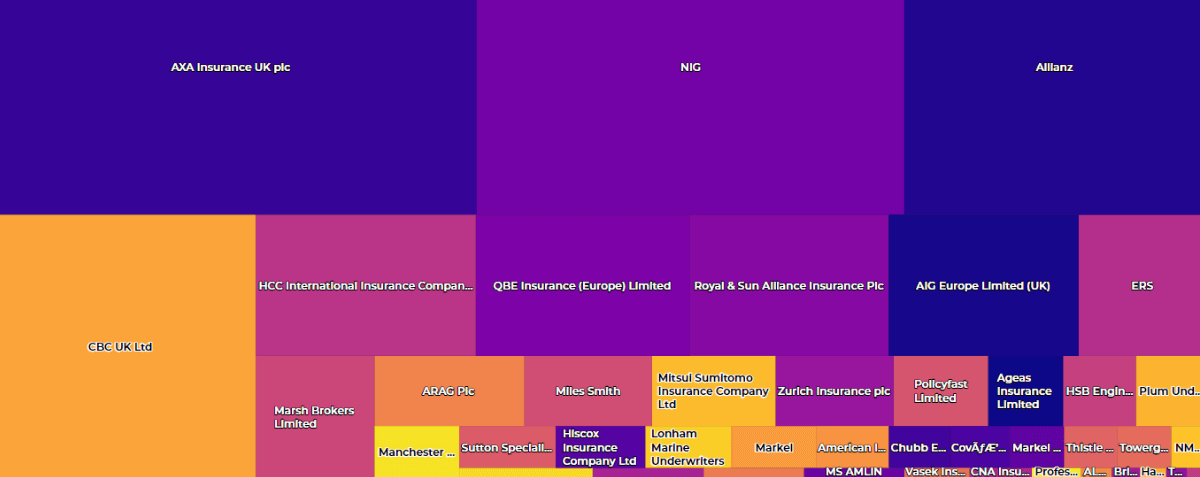

Gerry Conroy, Strategic Account Manager for Broker Insights, works with insurers to code their underwriting appetite into the platform. Gerry believes that the match-making service provides a game-changing benefit that is as yet largely unaccounted for:

“The platform ability to display data provides a clearer way of seeing which cases were coming up that brokers would like to move and the potential markets for each case. Underpinning this process is a contemporary record of each of our insurer partner’s appetites.

Where opportunities match with preferred partners on the Broker Insights platform, brokers are able to have highly productive conversations, removing a huge amount of wasted effort. Effort which is often not accounted for as it’s seen as an accepted part of the job. Broker Insights shines a light on this waste and provides the means to bypass it altogether, allowing brokers to focus their resources on growth.

Strengthen professional relationships:

People buy from people, as the adage goes. This is also true in terms of professional relationships between brokers and insurers.

Billy Coles, director of NexGen Insurance Solutions Ltd, believes that the platform has helped to strengthen their professional relationships and has contributed towards their 23% growth over the past year:

“Like many brokers, I prioritise communication skills amongst our team, both with clients and with insurers. Where we receive Notes of Interest from insurers via the platform, I task our team with getting a response back quickly to the insurer, to let them know where they stand and thank them for their engagement.”

Gain FTE back by removing wasted effort:

Alun McGeoghegan, head of trading for Broker Insights, believes that the platform plays a vital role in supporting growing brokers, particularly when the rate of growth impacts on the staffing.

No broker, whether growing or not, wants to see efforts go to waste, yet that’s exactly what happens day in and day out when sending market presentations to insurers without knowing their underwriting appetite. Sending a presentation may only take seconds but following them up takes far more.

We conservatively calculate that a broker using the platform to identify suitable markets for renewals they wish to move can save around 30% of the time it takes to engage the market, compared to a broker relying solely on prospective proposals.

By shedding light in insurer’s appetite, brokers can focus their follow ups by targeting markets that have an interest.”

Any broker that wishes to drive up their growth rate is encouraged to contact the team at Broker Insights to discuss their options.

UK Website

UK Website USA Website

USA Website