The word ‘data’ appears in practically every article on commercial insurance. It is at the core of the industry and the north star for its future.

To help get to grips with the topic and better understand the roles of those that work in the team at Broker Insights, we recently sat down with Head of Data, Andy Whiteley, for a chat about all things data science:

To begin, what is Data Science and Data Analytics?

In my view, working in a data team is simply business analytics, BUT business analytics on steroids.

Working with data allows teams such as ours to understand how a business operates and what makes a market tick, and when working at its real prime, it can help predict potential outcomes through detailed insight.

This offers a business the power of informed decisions and any business with informed decisions has a competitive advantage. Therefore, a good data team will be revenue-generating, not a cost.

What is the appeal of a role working with data?

If you have an inquisitive mind, then data is the place to be.

The excitement you get from following a path that leads to a “wow, I did not know that, and I can’t wait to publish this” moment, or even the frustration of following a path to the many dead ends you hit, is what makes the area so interesting.

No two days are alike and if they are, you are working in reporting and not data. Now, don’t get me wrong, reporting is important to any business as a statement or snapshot of where you are today, but if that is the same report each day, it is not data.

A data report should offer insight and actionable information that will turn the dial on ‘standard’ snapshot reports – that is the difference.

How is Data Science being applied at Broker Insights?

Here at Broker insights, we are some of the luckiest people in commercial insurance.

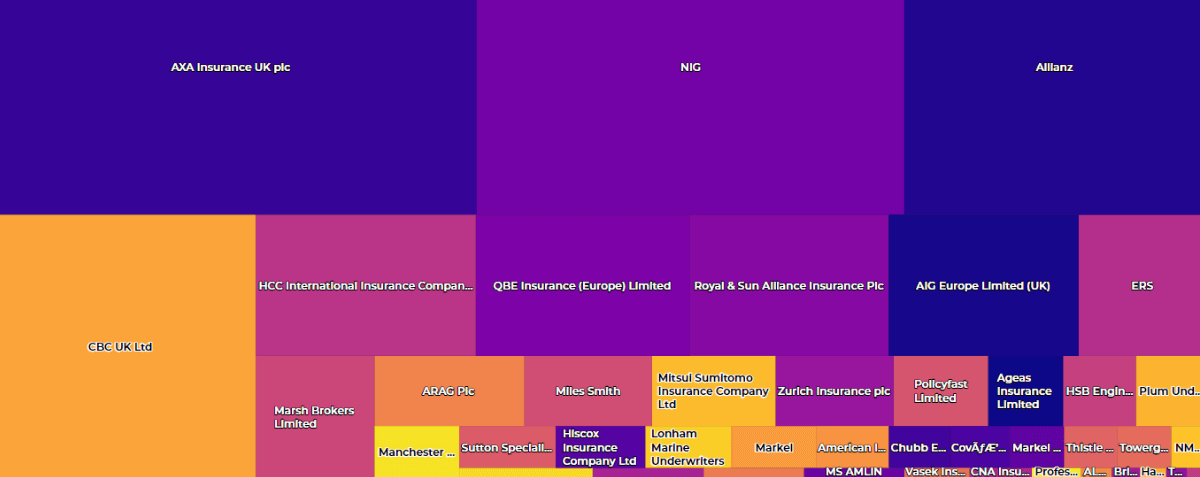

Our platform data provides a central view of the market, with c£1.5bn of commercial GWP data, spanning multiple systems and from brokers of all shapes and sizes.

This gives us a unique view of what is happening and what can be achieved if we look at things in slightly diverse ways, or just tweak what the market already does day-in, day-out.

With the platform acting as the hub of a wheel, I believe we are uniquely positioned to provide these insights. Our opportunities are not limited by any glass ceilings.

Feedback from partners reinforces my view, with some stating that the reports are “mind-blowing” and provide “insight that could not be obtained from any other source.” We can take a view across insurers, MGAs, large consolidators, mid-size brokers, and of course regional brokers, to deliver data insights that only we can obtain.

In fact, our only limitation is time. I want to do everything today but the team seems to believe there are not 48 hours in every day, which is a shame!!! So, we have to be patient.

We have to work through what we believe our customers would like to know, deliver what our customers ask to know, and shine a light on what is now possible via data insights.

It reminds me of the quote attributed to Henry Ford: “If I had asked people what they wanted, they would have said faster horses.” Ford’s customers could explain their problem, but without knowing that the Model T was possible, their only option was a faster horse. It’s a bit like that with data science – we are all still learning what is now possible via data analytics, and so much of what our team does is bring people on the journey of discovery.

There is never a dull day.

What’s next for Data Science at Broker Insights?

Broker Insights is the fastest-growing community of commercial brokers in the UK, connected by data. Month after month, the volume of GWP within the platform grows as more brokers join the community to help maximise the value of their data.

Platform functionality is increasing, with further new product developments on the horizon, which will help further strengthen the connection between our insurer partners and regional brokers.

This challenges us to continue to resource the data team to ensure that we provide the insights our broker and insurer partners require. The team has already grown by over 200% in the last year as we continue to grow as a business and our data sources get ever larger.

If I sound excited, it’s because I am! I have a job and a team where the opportunities open to us and indeed ahead of us are practically limitless. How many people can say that about their role?

In short, life is GREAT.

UK Website

UK Website USA Website

USA Website