Hindsight is 20:20, as the saying goes. It’s no surprise then, that past activity is heavily drawn on to provide a degree of certainty when planning in the uncertain world of commercial insurance.

As brokers and insurers approach the Q3/4 period of the year, commercial targets come into stark focus with past data analysis and pipeline management becoming particularly important.

Where smaller and standard risks are concerned, the engagement between broker and insurer will operate like a well-oiled machine. Larger cases above £50k, or specialist risks, are typically more complex and require more time and work to place.

Whether you are a broker or an insurer, the message is clear: When it comes to larger risks with greater complexity involved, make an early start! If you have complex risks to place or a focus on larger cases within the last two quarters of the year, now is the time to act.

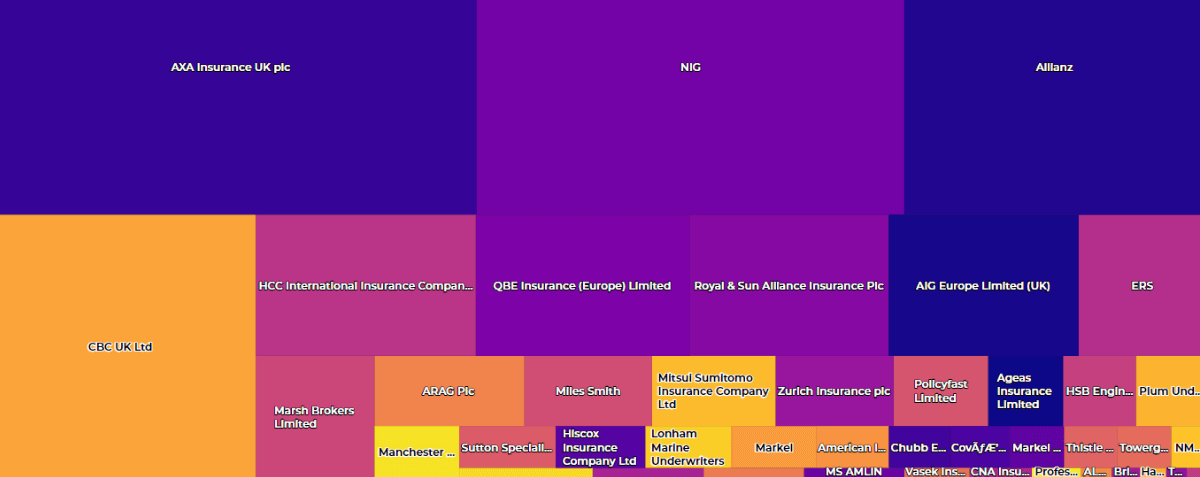

Our data team has analysed ‘large’ cases, where in-force premiums are over £50k, due for renewal in Q3 or Q4 of 2022. They have identified 849 cases within the Broker Insights platform that are held by non-partner markets. The aggregate expiring GWP totals £97.3M.

For brokers, addressing these upcoming renewals at the earliest opportunity is key. By using the platform’s appetite matchmaking service, you can identify Broker Insights insurer partners with an appetite for the risk. Alternatively, you can contact your Broker Insights Trading Manager to discuss options for your renewals.

Likewise, for insurers, looking ahead within the renewal window will allow for larger in-appetite cases to be identified and brokers to be engaged.

Our Head of Strategic Account Management, Martin Banks, has provided a few top tips for those seeking to address large cases and meet commercial objectives:

1: Foresight, not hindsight focussed:

My first top tip is to move away from using data to explain what has happened and to increasingly use it to affect what will happen.

Driving your business forward is a bit like driving a car and it’s helpful to contrast the size of the windscreen through which you look forwards with the size of the rear-view mirror, which allows you to look backward. Use your time and energy in those sorts of proportions. Be future-focused.

You can use the rear-view mirror to provide you with information about where you are coming from; what sort of business are you most successful on and then look forwards to see where that business is.

Use the platform and its data tools to identify the large cases that can help you accelerate into the end of the year, as well as get a fast start to 2023! Which brokers have those cases? What is the plan to engage with them to have a case-based, data-driven dialogue?

Users of Broker Insights know that the platform delivers Pipeline Management capability which pinpoints opportunities to bring brokers and insurers together on cases of mutual interest.

2: Start early:

With larger cases taking longer to market and land, both insurer BDMs and brokers need to be working well in advance, proactively not reactively using the insights within the platform.

Larger cases require longer run-ups. Brokers can use the platform to scan the horizon and learn which Broker Insights partner insurers have underwriting appetites that match their clients’ needs.

Similarly, insurer BDMs and Development Underwriters can look months into the future to establish which brokers offer substantial opportunities for them and can engage with those brokers early to signal their interest in specific cases.

You snooze, you lose! If you are not working these trophy cases early, then someone else probably is.

3: Collaborate:

We are seeing increasing use of tri-partite calls involving the Broker Insights Trading Team, broker executives, and insurer distribution professionals to hold data-led discussions on specific opportunities.

It’s heartening that the demand for these conversations is coming from both the broker and insurer communities with both sides seeing the benefits that the platform data provides and the added value that the Trading Team can contribute.

Don’t be shy in asking for these meetings, your peers certainly aren’t!

UK Website

UK Website USA Website

USA Website