Collectively, brokers across the UK send thousands of market presentations to insurers every working day.

Unfortunately, many of these presentations fall out of insurers’ appetite and as a result, it’s feasible to expect that the decline rate for presentations can easily reach 50% or more.

With the potential for half of all presentations issued to the market being declined, it is fair to say that capacity for underwriters can quickly becomes stretched, impacting on response rates, service for presentations that aren’t declined, and the bottom line.

Acknowledging that these issues can have a significant impact on service standards, it is in both insurers’ and brokers’ interest to do what they can to reduce the decline rates for presentations.

Brokers will always issue presentations widely, many of which get logged without consuming significant amounts of resource, either for the broker or the insurer. The key challenge comes when a broker follows up with an insurer, only to find later on that the risk is not of interest. The follow up consumes far more time throughout the distribution chain; time which could easily be saved if suitable markets were identified from the outset.

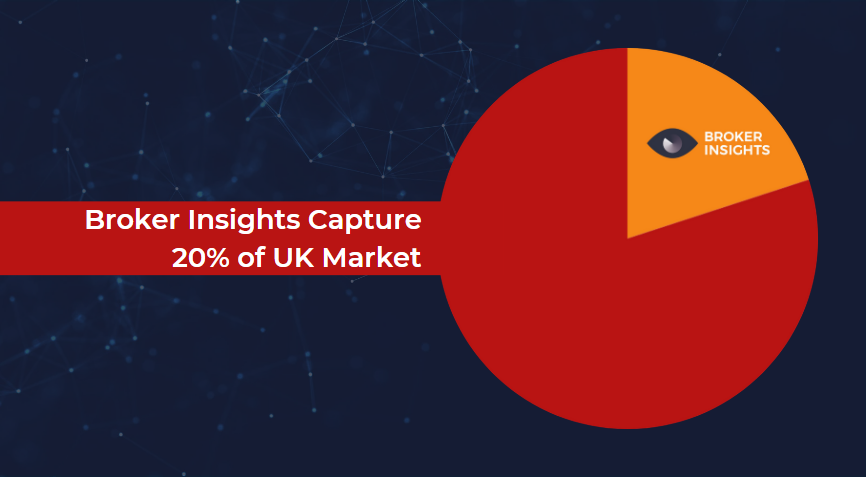

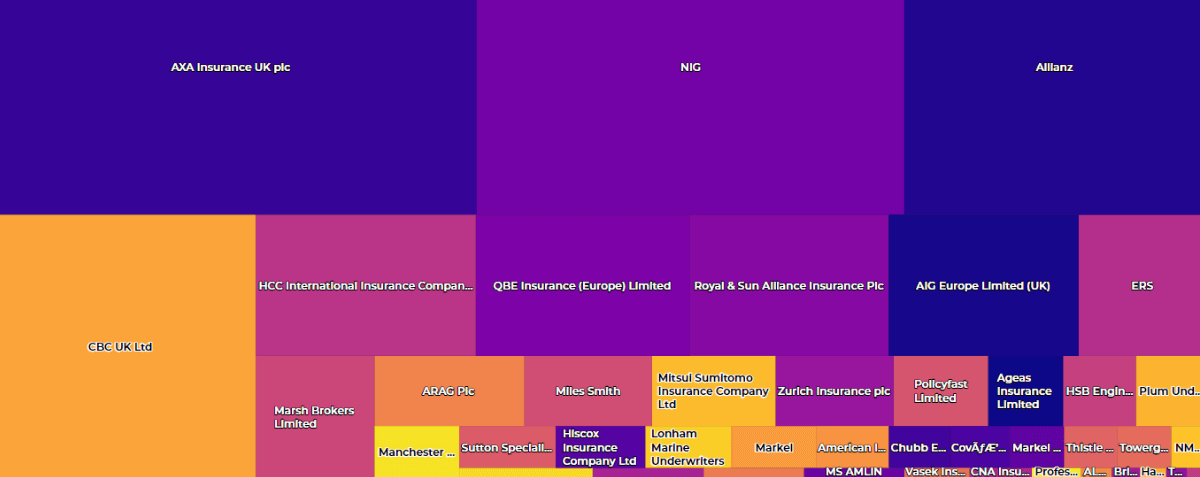

The Broker Insights platform contains in excess of 500,000 commercial insurance policies, which are cross-referenced against over 500 appetite parameters set by our insurer partners. We refer to this cross-referencing process as ‘intelligent matchmaking’, using data to find the overlap between an individual case and insurer appetite.

These appetite parameters enable the platform to intelligently match renewal opportunities within brokers’ held books and pinpoint markets with an appetite for each risk.

This drive towards using data to connect renewals with insurer’s appetites is key to understanding how the platform contributes to reducing decline rates.

Brokers are encouraged to routinely use the platform as a key component of their placement strategy, matching renewals they wish to market against insurers with a defined appetite for that risk, with the outcome being far more productive conversations following on from submission of the presentation.

We estimate that this simple adjustment to working practices can save brokers around 30% of the time they would otherwise spend chasing up risks with markets that have no interest. For more information, try our time saving calculator.

The c30% time saving would be mirrored on the insurers’ side of the distribution chain, as a higher degree of relevance for inbound enquiries results in a much lower decline rate and stronger relationships, which then hopefully has a knock on to a higher win ratio.

In conclusion, everyone wants better service. The key to achieving this is to explore the root cause of the challenge. Mitigating wasted resources may well help to unlock additional capacity for both brokers and insurers, which can only be a good thing.

UK Website

UK Website USA Website

USA Website