Every organisation’s approach to business class naming conventions is subtly different. One organisation’s ‘Commercial Combined’ may be another’s ‘Small Commercial Combined’ or ‘Commercial Combined Package’. For some, it’s called ‘Directors and Officers Liability’ while for others, it’s referred to as ‘Management Liability’.

These two examples of discrepancies in the descriptions used for classes of business are the tip of a much larger iceberg.

The lack of standardisation for class descriptions presents a huge challenge when analysing data relating to classes of business and also creates a significant amount of unaccounted friction up and down the distribution chain, along with missed commercial opportunities.

To overcome this challenge, Broker Insights has developed a sophisticated proprietary process for categorising and unifying the varying class descriptions used by brokers and insurers:

- To begin, the platform ingests broker renewal data from a broker’s software system. The platform is system agnostic, currently accepting data from 19 separate broker software systems, with new or bespoke systems being included as they arise.

- Risk data is then quality checked to ensure that all necessary fields are in place, before being enhanced via API links with sources such as Companies House.

- Once complete, the step is to interpret the varying class descriptions used by brokers and re-classify them into a standardised format which underpins the platform’s unique match-making technology.

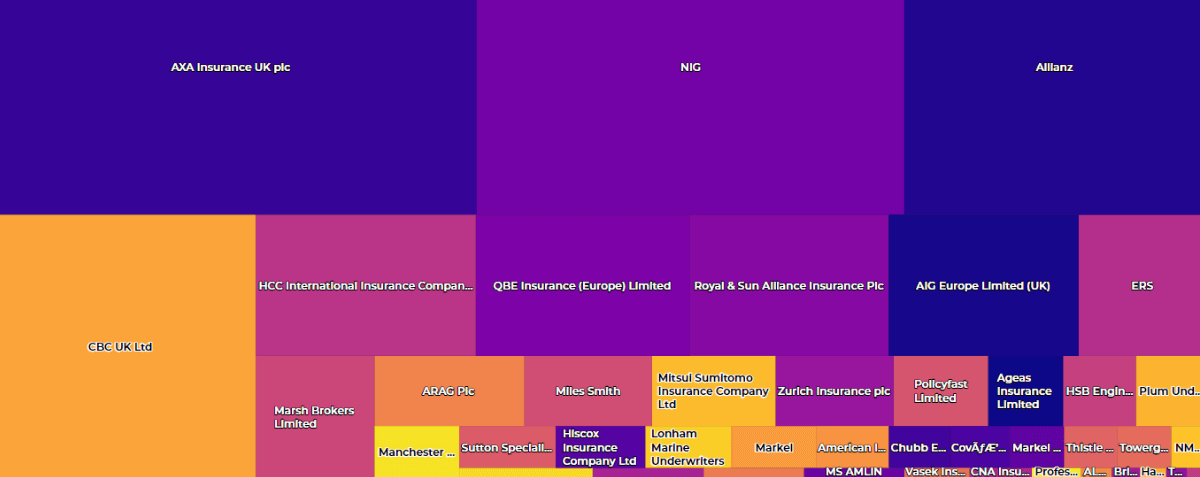

This unique process enables the platform to interpret renewal risk data classified in 1,583 different product codes or descriptions and determine that risks within the UK market can be broadly categorised into 132 separate classes.

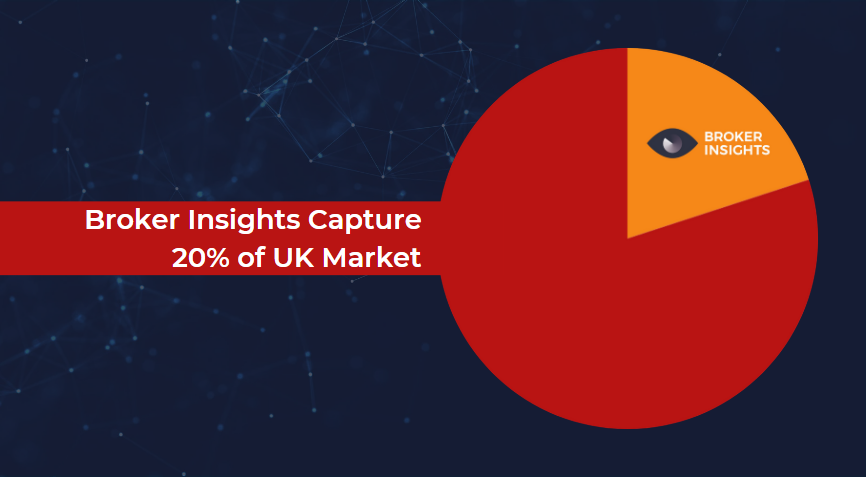

With over £1.3bn GWP, 1,000+ insurer markets, and 500,000+ policies from 460+ broker offices now within the Broker Insights platform, it is easy to appreciate the need for and impact of this innovative solution in making sense of both appetite and risk descriptions.

Head of Trading, Alun McGeoghegan, feels that Broker Insights’ innovative approach plays a crucial in connecting brokers with insurers.

“Broker Insights is the only organisation in the UK using this innovative approach. Thanks to the alignment of class descriptions, every broker within our community is able to explore their placement strategy at policy level and connect with our insurer partners regarding in-appetite risks. This game changing functionality is made possible by Broker Insights ability to work with multiple broker software house and categorise class descriptions into a standardised format.

“Looking back on a pre-Broker Insights world, or for those not yet benefiting from the platform’s technology, it’s shocking to think of the amount of wasted effort, friction, and the potential for missed opportunities due to mis-matched class descriptions.

“Brokers and insurers being able to connect with each other without any ambiguity or further work on their part to interpret descriptions is a fundamental requirement and a clear example of the benefit that Broker Insights delivers for our partners.”

If you would like to know more about the issues discussed in this article, contact the team at Broker Insights.

UK Website

UK Website USA Website

USA Website