Recent improvements to the platform have seen the time it takes for an insurer’s appetite to be mapped or updated massively reduced.

As a result, insurer partners can pivot faster and better capitalise on opportunities shown in the data, while for brokers, the platform takes a giant leap forward in better helping them to identify insurer appetite.

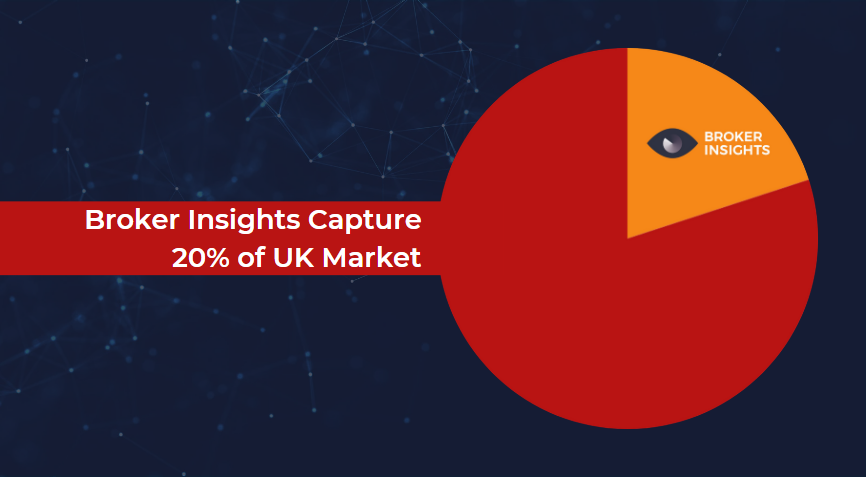

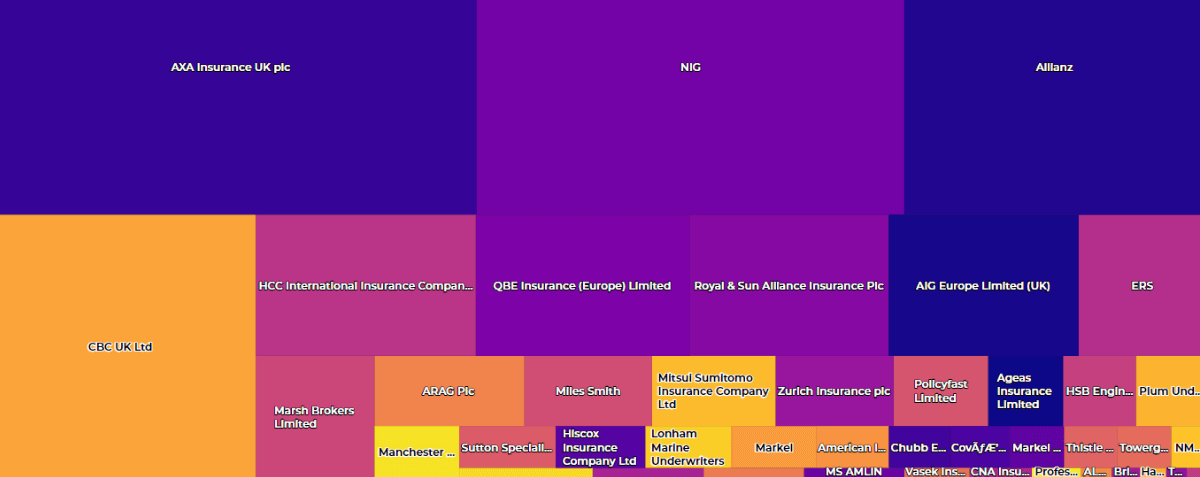

The Broker Insights platform contains in excess of 500,000 commercial insurance policies, which are cross-referenced against over 500 appetite parameters set by our insurer partners. We refer to this cross-referencing process as ‘intelligent matchmaking’, using data to find the overlap between an individual case and insurer appetite.

Collating insurers’ appetite is no easy task. Take into account the variation in naming conventions between insurers and brokers, the requirements for premium, exclusions, etc., and you can begin to appreciate the challenge of mapping multiple requirements in one digital environment.

Following extensive research and development, Broker Insights is proud to announce that its market-leading intelligent matchmaking technology has become even better.

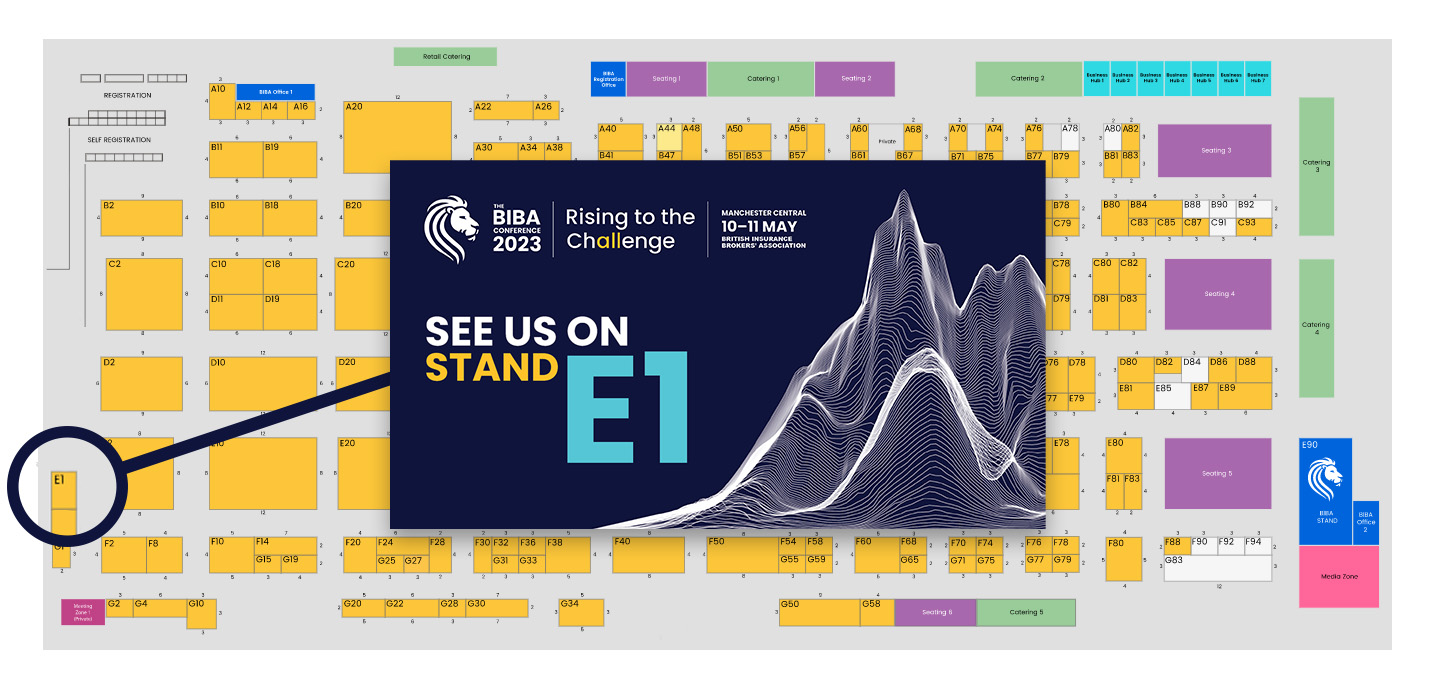

From May 2022, when an existing insurer partner changes their appetite, or a new insurer joins the platform, updating the platform parameters can be completed in a few short steps, with any changes being visible within a 24-hour period.

This latest update will allow insurers to quickly identify relevant opportunities, and for brokers, the development further enhances the platform’s ability to help them pinpoint insurer appetite and submit targeted market presentations.

Commenting on the announcement, Head of Trading, Alun McGeoghegan, said: “Broker Insights works closely with our broker and insurer partners. We understand the challenges they face; for insurers, communicating their appetite to the market is a significant undertaking.

“Insurers spend a lot of time and money educating the market on the classes of business they are looking for. Yet, in a market with over 1,000 carriers, all likely to be doing the same, brokers can quickly become swamped with communication.

“For brokers, maintaining an accurate and contemporary understanding of insurer appetite must feel like an uphill challenge, and to add to the problem, when an insurer’s appetite changes, the whole process starts again.

“Therefore, for both Broker Insights insurer partners, and members of our broker community, the platform fulfils a vital role in helping to communicate and educate the market regarding contemporary appetite. The fact that it’s just become even quicker is welcome news indeed.”

UK Website

UK Website USA Website

USA Website