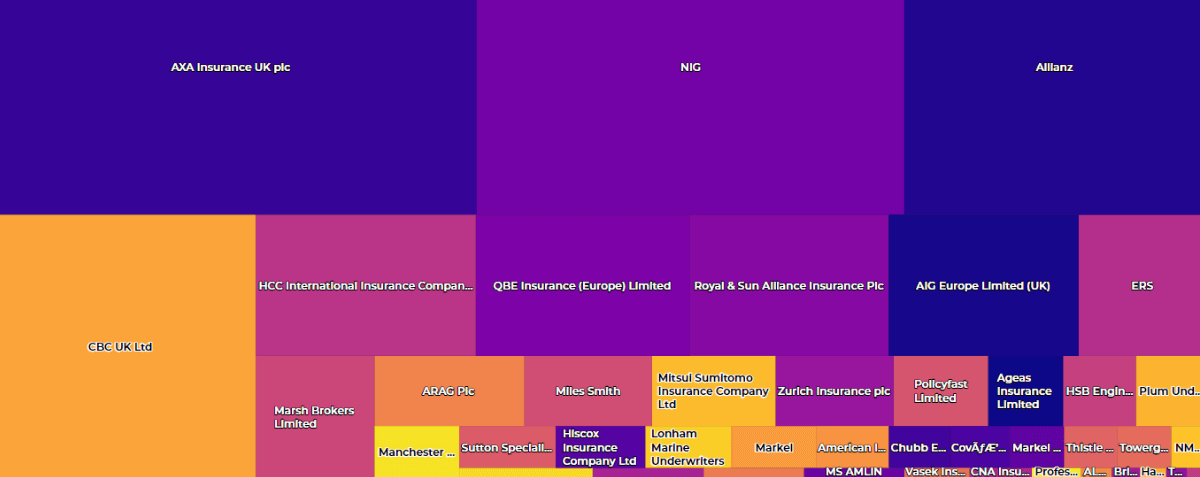

To conduct analysis of product classes across the UK market, you first need to standardise the varying class descriptions used by brokers and insurers.

In October’s article, we explored the platform’s unique ability to categorise market data into 132 standardised class descriptions, and the benefit of doing so for brokers and insurers.

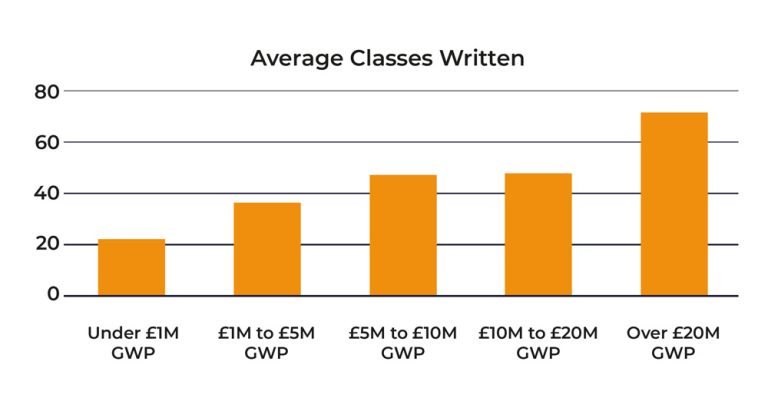

Having aligned class data relating to over £1.3bn of commercial GWP from over 460 broker offices, our data team was able to explore the number of classes written by brokers in relation to the size of the overall held book. They determine that on average, brokers handle client risks across 41 categories.

While the average is interesting, the standout finding was the correlation between the size of the broker and the number of classes handled. On average:

- brokers under £1M GWP write business in 24 classes;

- £1M to £5M manage 38 classes;

- £5M to £10M handle risks across 48 classes;

- £10M to £20M oversee 49 classes;

- and brokers with over £20M GWP handle 72 classes.

In short, the report showed that as a broker grows, so does the number of classes it manages.

Sources of growth can vary, either coming from success with existing markets, expansion into new markets, untargeted organic growth, or in some cases, through acquisition.

The data reinforces the notion that growth, whatever the source, brings increased complexity, which must be accounted for.

Commenting on the findings, Head of Trading at Broker Insights, Alun McGeoghegan, feels that the impacts of the correlation are worthy of further consideration.

“Initially, these findings seem obvious – larger brokers write business for more classes; but dig a little deeper and it throws up a few more issues.

“When growth results in an increase in number of classes being handled, it also means that staff must collectively maintain product knowledge for each additional class and find suitable markets for them, while maintaining knowledge of policy wordings, covers, etc.

“Yes, a larger broker will have more staff to handle these classes and maintain the knowledge clients rely upon, but the likelihood of strategic drift will also increase, as more staff and more classes takes a toll on placement strategy, insurer relationships, etc.

“Broker Insights fulfils a fundamental role for growing brokers and insurers, helping to overcome the growing pains of an increase in the number of classes and maintain a unified placement strategy.

“The platform’s ability to interpret and standardise the names of product classes is also vital in overcoming the challenges associated with growth, enabling brokers and insurers to join their workflows together seamlessly.

“As we work on future platform developments, the output of reports such as this will help shape our thinking around the role of the platform in helping brokers and insurers manage upsell or cross-sell opportunities and the increasing complexities that come with growth.”

If you would like to learn more about any of the issues in this article, please contact a member of the Broker Insights team.

UK Website

UK Website USA Website

USA Website