The Broker Insights team routinely analyses platform data sets and KPIs, to determine platform performance and monitor market trends.

Of the various key performance indicators we monitor, one in particular always grabs the attention of the team and it relates to brokers moving GWP from non-partner insurers to our insurer partners.

This simple KPI represents a number of benefits and serves as a quantifiable benchmark for the role the platform plays, both for our insurer partners and also for the broker community.

In effect, it’s a win-win-win model, whereby brokers win by placing more business with preferred markets, insurers gain new business beyond their market share by having in-appetite opportunities presented to them by the platform, and all the while, the Broker Insights ‘intelligent matchmaking’ data set enhances.

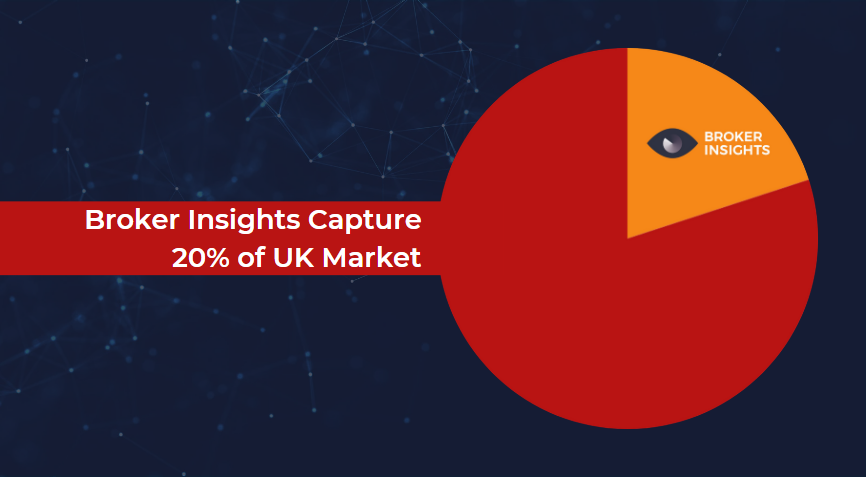

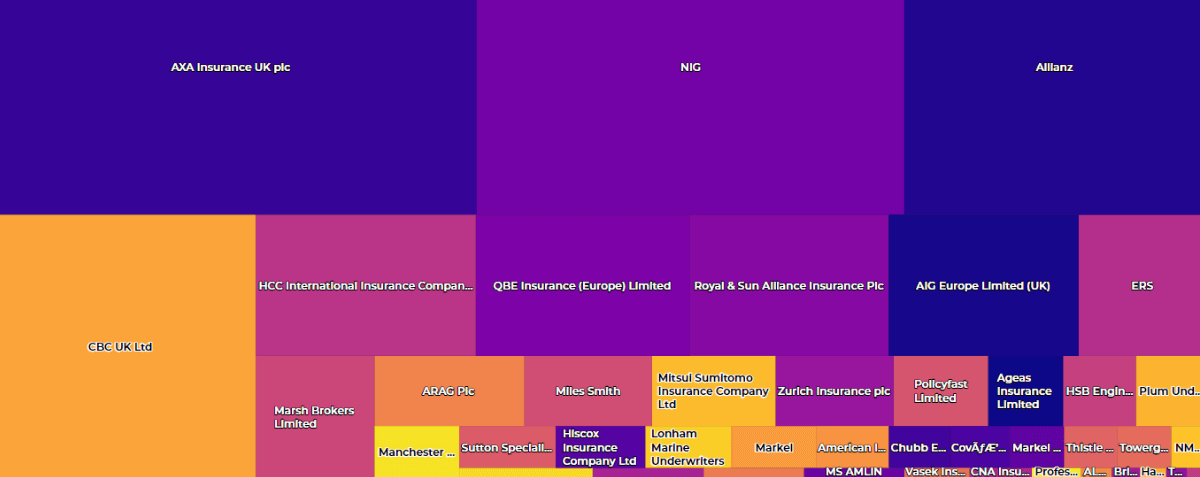

As of 1 Jan 2021, 11.1% of the total GWP within the platform was held by our insurer partners. Fast forward to 31 December 2021 and the GWP placed with these insurer partners by the same brokers had grown to 13.6%, which is an increase of 31% within twelvemonths. When we compare this performance to non-partner insurers over the same period, large insurers had grown by 7%, medium by 22%, and small insurers by 14%.

This equates to average non-partner growth of 14%, compared to 31% for our insurer partners.

In short, insurers that utilise the platform are growing more than twice as fast with our broker community than non-partner insurers.

When analysed at class level, if we look at a common class, Commercial Property, we see a similar trend.

Our insurer partners property book grew by 39% with our broker community in 2021, while non-partner insurers averaged just 15%.

Commenting on the findings of the report, Chief Commercial Officer, Alan Sanderson, said: “This simple KPI speaks volumes about the beneficial impact the platform has on insurer/broker relationships.

“While the report draws from 2021’s data, as of June 2022, the platform contains over c£1.2billion GWP, further demonstrating that when data is used to signpost opportunities, both insurers and brokers can move forward together. As can clearly be seen by the growth figures, they are doing so very successfully.”

UK Website

UK Website USA Website

USA Website