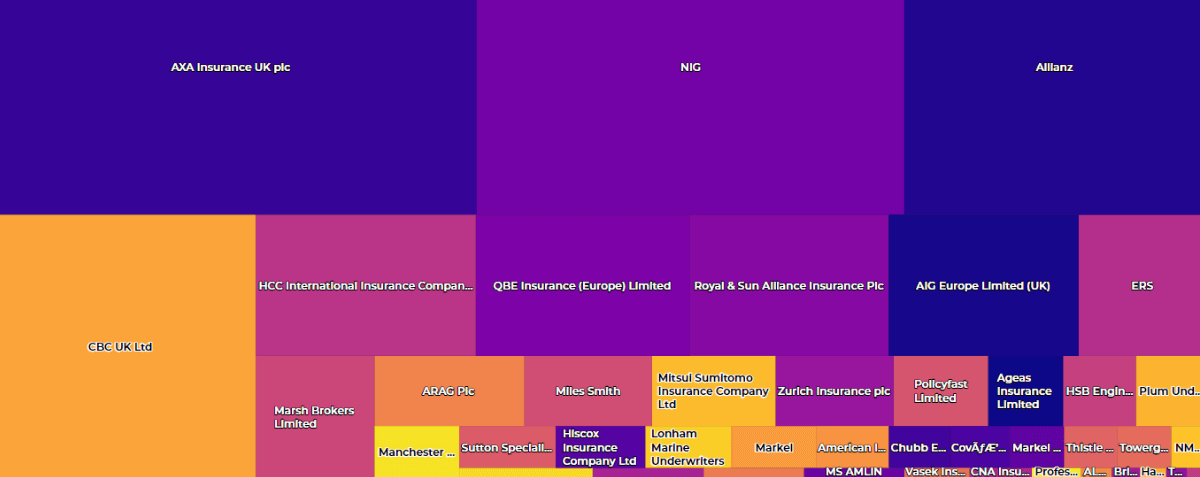

Core to the benefits that Broker Insights delivers for its insurer partners is the ability to identify ‘net new’ business beyond existing trading relationships and ‘match-make’ opportunities that are within an insurer’s appetite.

It was this benefit that recently led Markel UK to open discussions with a firm regarding a professional indemnity opportunity. Utilising the Note of Interest feature, Markel UK contacted the broker regarding the opportunity, with subsequent conversations highlighting that the broker was unaware that the risk was within Markel’s appetite.

Commenting on the successful placement of the business, Simon Marriott, business development manager for Markel UK, reflects on the process and benefits of utilising the platform:

“Following Markel joining the Broker Insights panel, a review of broker relationships was undertaken and a select number of brokers which whom we had little engagement with were highlighted.

“As the Business Development Manager tasked with implementing the findings of the review, I made a call to the Account Handler regarding a PI case. The Account Handler was not aware that it would be within Markel’s appetite and forwarded the quote that day, following which an Underwriter reviewed the details and quoted shortly afterwards. Thanks to the quick response and flexible underwriting Markel were able to ‘Bind’ the quote very quickly.

“Broker Insights was instrumental in highlighting the opportunity, prioritising the response and discussing requirements. The platform provided line of sight of an opportunity that we may not have otherwise had, leading to a happy client, broker and a new relationship for Markel.”

Head of Insurer Relationships for Broker Insights, Alun McGeoghegan, believes that Markel’s use of the platform shows the benefits of insurtech solutions working in harmony with traditional processes:

“Insurers and insurance brokers are highly professional people with a wealth of knowledge and experience that they draw upon each day to meet the demands of their roles. Broker Insights has been developed to compliment the current skillset and workflows of insurers and brokers, and to enhance the tools they can call upon.

“The platform’s data-driven approach clarifies underwriting appetites, highlights opportunities and provides an efficient means for all parties to engage over specific risks. When combined with the added benefits of extended MI (Management Information) dashboards, improvements in speed of engagement, communications channels and Notes of Interest, Broker Insights successfully delivers strategic advantages to all those utilising the platform.”

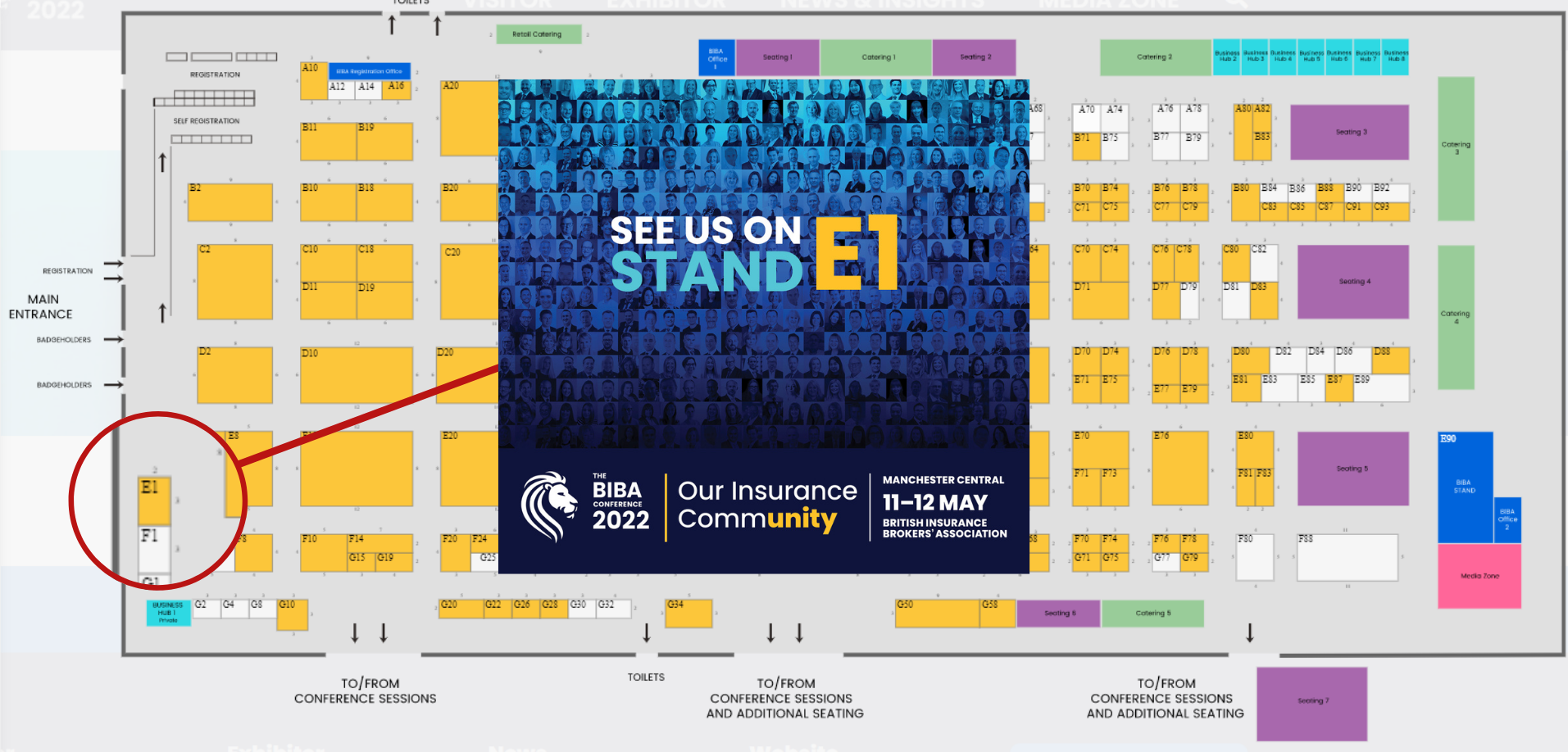

If you would like to learn more about the benefits Broker Insights will bring to your business, contact a member of our team today to arrange a demonstration.

UK Website

UK Website USA Website

USA Website