Grow revenue! Cut costs! For many, these are the familiar twin-pillars of commercial growth.

Whether you are an insurer or a broker, greater efficiencies and increases in revenue are central to most business decisions.

For insurers, the commercial annual planning cycle typically begins in July, during which time known opportunities identified from high-level aggregated data sets will be mapped against objectives, in an attempt to outline how goals will be met over the coming year.

The same is true for brokers who will typically review their placement strategy and use high-level aggregated data to identify opportunities or seek out efficiencies.

Once the ‘known-knowns’ have been factored into the plan and obvious opportunities have been exhausted, it is not uncommon to find a gap from this ‘bottom up’ process to a ‘top down’ ambition or ‘stretch challenge’ put forward by leadership. This drives the questions ‘how do we fill any remaining gaps to target?’, ‘where might additional growth come from?’ and ‘how can efficiencies be achieved?’

While aggregated data is crucial to distribution and placement planning, high-level views crucially lack the ability to ‘plug holes’ in budgets with actionable insights. This traditional shortcoming has often been met with simplistic percentage increase targets applied on a straight-line basis across the business with no reflection of trading realities.

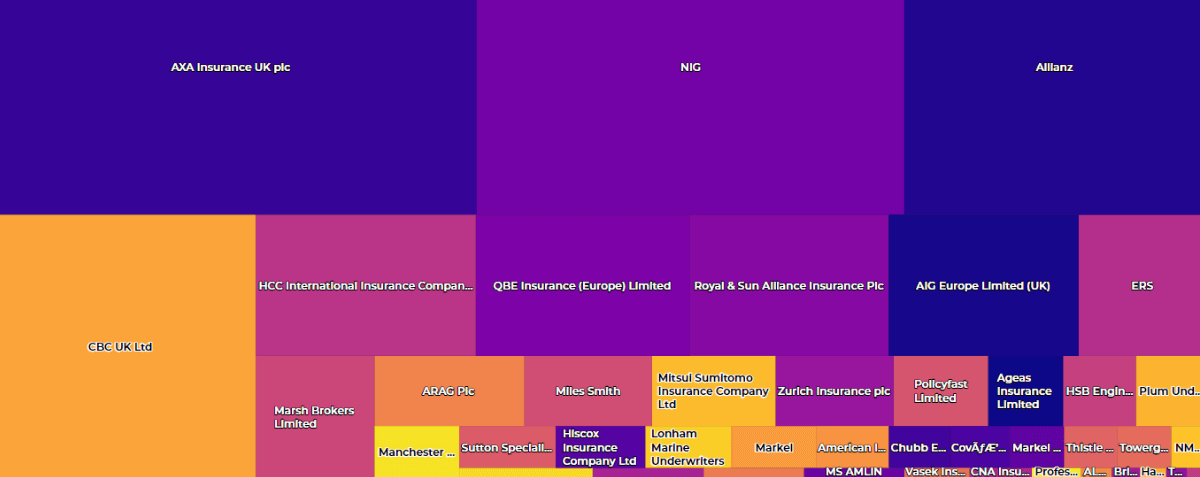

To plan with increased confidence levels, both during the annual cycle and also as part of any re-forecasting process in-year, insurers need access to information at a regional level, at a broker level, and at the microdata level which allows opportunities to be identified case-by-case.

Brokers have exactly the same challenge, using the policy level data they hold, they can plan placement strategies months in advance and goals can be easily married together for the target timeframe with contingencies ready to be flexed in year for all parties, at any time. Tools which enhance policy level management information also allows firms to strengthen their governance oversight and ensure all staff are adhering to the agreed placement strategy.

Alan Sanderson, Chief Commercial Officer at Broker Insights believes that the platform is an invaluable tool for the market, to help meet stretching commercial objectives.

“Whether you are a broker or an insurer, when it comes to planning, at some point you will end up at policy level, which means that you need tools that support the end to end process and don’t just focus on high-level aggregated data.

“Broker Insights provides this tool kit and can actively show, at a policy level, how gaps in budgets can be filled.”

Alun McGeoghegan, Head of Trading at Broker Insights, sees the Trading Team’s role as being pivotal in maximise the latent potential of data.

“The Trading Team sits between our insurer partners and broker community, providing a support mechanism to help maximise the platform’s functionality. We know that the platform provides industrial strength capability, but we also recognise that all parties are on a change curve and that if we are to get the most out of our technology and use it to bridge the knowledge gap in the distribution chain, we must proactively provide support and guidance.

“Working alongside our colleagues in the Training Team, we are in daily contact with brokers and insurers to help them fully utilise the platform at both aggregated data and policy data levels, to effectively manage their placement or distribution strategies.

“I would encourage any of our existing partners, or those seeking to better utilise their data, to get in contact to explore what can be achieved when we apply our technology to the end-to-end data process.”

UK Website

UK Website USA Website

USA Website